How to Become a locum vet; A Comprehensive Guide 📋

An in-depth guide on how to become a locum vet, exploring job hunting methods, accounting options, costs involved, and the benefits of locum work.

Sections

- What is a locum vet? 🤷

- How to find work? 🔎

- How will I be paid? 💰

- Which costs to think about? 💸

- Locuming as a soletrader vet checklist ✅

What is a locum vet?

The term ‘locum’ originates from Latin and simply means ‘a person who temporarily fulfills the duties of another’. In the context of a locum vet, it signifies that the individual is not tied to one specific practice. The role of a locum is to step in when staff levels are low or temporary cover is needed, such as during instances of illness, maternity leave, or vacation.

Given the nature of locum work, positions are typically dispersed across the UK. Some practices have one-day vacancies (usually due to unexpected events), while others offer longer periods (due to leave or vacation). Some locum vets engage in locum work alongside long-term part-time employment in a specific practice, while others fully commit to locum work on a full-time basis.

Why do people locum?

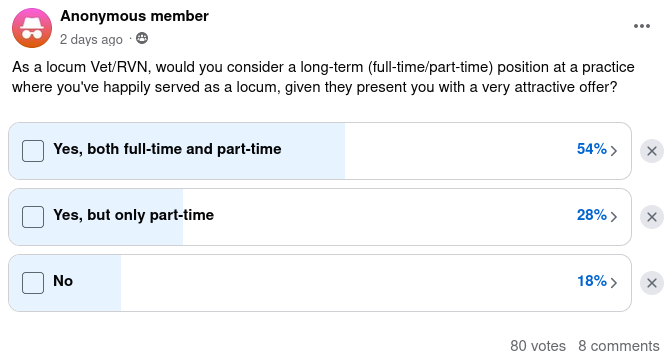

The most commonly repeated argument is that locum work provides fewer hours and better pay, along with more freedom to take holidays or days off when desired or needed. We surveyed locum veterinary surgeons and registered vets, asking whether they would return to long-term employment. Out of the 80 responses, the majority indicated they would return to full-time employment if the conditions were favorable enough. However, many comments suggested that working long-term as an employee almost always means more hours, less pay, and less flexible holidays.

This might suggest that locum work is a way to push back against practices for improved working conditions, but there are also benefits for the practices themselves. Hiring locums instead of full-time employees carries less risk, as offering someone a full-time position is a significant and costly commitment. Having locums also reduces the administrative overhead for practices, as it essentially creates two independent businesses working together, each handling their own accounting and operations independently.

What skills do you need as a locum?

The more independent and skilled you are, the easier it will be to take on locum shifts. These shifts typically require comfort with sole charge, so ideally, you should have a few years of full-time work experience. However, as the popularity of the locum employment model increases, there are more and more opportunities for less experienced professionals.

How to find work?

Vetjobhunt.uk

The easiest way to connect directly with practices that have active locum vacancies is by using Vetjobhunt.uk/locum-jobs. Our automatic 24/7 matching service is perpetually free for job seekers and small practices. We are not an agency, so once you get matched, you communicate directly with the practice. This approach offers the best of both worlds - it saves you time spent on searching and ensures that you don’t face a pay cut due to agency fees. We will discuss more about this later.

Facebook groups

Some practices also post locum vacancies on dedicated Facebook groups. Simply search for “vet locum” and join the largest groups. The advantage here is that you can again get in direct contact with practices. However, constantly monitoring the group feed for suitable vacancies is not realistic. (That’s why we created the automatic locum shift matching at Vetjobhunt). Be aware that recruiters also post in these groups - we will discuss more about this later.

Contacting practices directly

You might consider searching for practices nearby, but it’s important to note that not all practices require or employ locums. Additionally, the response rate to emails varies significantly among practices.

Recruiters / Other middlemen

Alternatively, you could employ an intermediary, such as a recruitment company or an umbrella company, to find a job for you. While this approach provides convenience, it’s important to remember that these companies need to generate profits. Consequently, the practice typically pays an extra 60+ pounds per day for their services, which could ultimately reduce your salary.

How will I be paid?

Soletrader

You have multiple options, but we recommend becoming a sole trader. This is not only the most popular choice, but also the most cost-efficient. There are only a few steps to take and anyone can manage them. You can read exactly what you need to do in Section about locuming as a soletrader

Limited company

Some locum professionals operate through a limited company. However, for the majority of people, the tax benefits are negligible and come with additional legislative overhead compared to being a sole trader. You should only consider setting up a limited company if you understand precisely why you’re doing it.

Umbrella company

The final option is to work through an umbrella company. This company acts as an intermediary between you and the practice, so you get paid as if you were an employee. The downside is that you’ll pay the same national insurance and tax contributions as you would being a sole trader or a limited company. Additionally, your pay will be reduced because the umbrella company has its own operational costs. Therefore, you will likely earn the least with this option.

Which costs to think about?

VDS cover

Some locums maintain their own Veterinary Defence Society (VDS) coverage, while others are covered by the practices they work with. Therefore, it’s advisable to familiarize yourself with a few practices in your area that employ locums and ask them what works best. You can find more information on the VDS cover website.

RCVS

The fees for the Royal College of Veterinary Surgeons are compulsory and can be found here.

Pension, sick leave, vacations

When you’re employed, benefits such as pension, sick leave, and vacations are automatically provided. However, when you’re locuming, you need to ensure you charge enough on the days you actually work to cover the days when you’re not working (due to sick leave or vacations) and also your retirement (pension).

Only about 16% of sole traders (not just in the veterinary industry) in the UK are part of a pension scheme. However, it’s highly recommended and there’s plenty of advice available online. You can find more information here.

Uniforms, commute…

It is important to note down all your expenses so, that you cam decrease your tax and NI contributions.

Accounting for locums

You don’t necessarily need to hire an accountant; you can manage everything yourself. You’ll need to keep a record of all your business income and expenses. It’s best to create a separate bank account for your income and expenses. You don’t need a special business account (which usually comes with fees). You can simply open a free personal account in another bank and use it solely for this purpose.

CPD

You can find more information on the RCVS website. Continuing Professional Development (CPD) is not necessarily a cost, as you can undertake your own CPD for free, for example, by reading a book or listening to a podcast. You can find more information here. Some people choose to pursue a certificate as part of compulsory CPD. While this is more of an investment in yourself, you can also claim this as an expense to reduce the tax you have to pay.

Locuming as a soletrader checklist

Locuming as a sole trader is the easiest way to get started. This guide serves as a comprehensive checklist of what you need to do. We’ve divided the checklist into two parts: the first part includes general steps that any sole trader needs to take, while the second part is more specific to the veterinary industry. You need to complete both sections.

General soletrader checklist

Set up as a soletrader

You need to notify the government that you’re operating as a sole trader. The process is quick, simple, and free. Just visit the official website and register by clicking ‘Register for Self-assessment’. Essentially, this is a way of informing the government that they should expect an annual tax return from you. You don’t need to concern yourself with Value Added Tax (VAT) as long as your turnover is less than the threshold. You can find the current threshold here.

Accounting

You don’t necessarily need to hire an accountant; you can manage everything yourself. It’s important to keep a record of all your business income and expenses. We recommend creating a separate bank account for these transactions. You don’t need a special business account (which usually incurs fees). Instead, you can simply open a free personal account with another bank and use it solely for this purpose.

Bank Account

We recommend setting up a free bank account dedicated solely to your locum work, as this will make it much easier to track income and expenses. You can create a free personal account with any bank for this purpose; a paid business account is not necessary.

We suggest using Mettle (created by NatWest). The benefits of Mettle are that it’s completely free and specifically designed for sole traders and small businesses. It offers useful features like estimating National Insurance/tax contributions and setting aside a portion of your pay for tax. Mettle also provides free access to an accounting software called Freeagent (normally £19 per month), which easily syncs with your Mettle account. This is not a paid promotion - we at Vetjobhunt use it ourselves and believe it’s the best option available.

Weekly Accounting

On a weekly basis, you will likely only need to:

- Create invoices for practices.

- Keep track of whether the invoices have been paid.

- Use the money in your account to pay yourself and cover the costs associated with locuming.

There are many free online tools available for creating invoices. If you create an account with Mettle, as described above, you’ll get a free Freeagent subscription which you can use to generate invoices. Freeagent can also automatically match payments in your Mettle bank account (which is synced with Freeagent) with the invoices created from Freeagent. While this isn’t something you need to start doing immediately, you might want to consider it as you become more comfortable with the process, as it can save you time.

Annual Self-Assessment Tax Return

The official guidelines are written very well, so we will simply provide a link to the official website. The tax year runs from April to April. You have until October, following the end of the tax year, to file your self-assessment.

Veterinary specific checklist

VDS

Some locums maintain their own Veterinary Defence Society (VDS) coverage, while others are covered by the practices they work with. Therefore, it’s advisable to familiarize yourself with a few practices in your area that employ locums and ask them what works best. You can find more information on the VDS cover website.

RCVS membership

The fees for the Royal College of Veterinary Surgeons are compulsory and can be found here.

Essentials items for locums

- Dosimetry Badge - In the UK, this is a legal obligation and must be adhered to whenever you’re in the vicinity of x-rays. If you’re employed at the same practice for several months, they’ll typically order one for you. However, ultimately, it’s your duty to order it, put it on, and ensure it’s sent for its quarterly assessments.

- Professional name badge - Creating a positive impression on both your new colleagues and clients is crucial, and let’s face it, remembering names can be challenging for many! The easier your name is for your co-workers to recall, the quicker they’ll begin to include you in the morning coffee break.

- Professional uniform - Every veterinary clinic has its own unique dress code - some vets wear scrubs, some wear ties and in some places, sleeveless attire is not permitted. Certain clinics provide uniforms, while others require you to change into a fresh ensemble upon arrival each day. The optimal approach to this is to directly inquire from your prospective manager about what they’d like you to wear on your first day, and if there are specific dress codes you need to be cognizant of.

- Footwear - This is largely dependent on the specific practices of the workplace, and it’s advisable to confirm with your employer before you begin. Numerous practices these days necessitate having dedicated shoes for the practice, which you put on upon arrival or for surgical procedures. Ensure that the shoes you bring are, at a minimum, enclosed and clean.

- Food - Truly, it’s essential to pack snacks. The unpredictability of the day means that an emergency could transform your hour-long lunch break into a quick three-minute snack while you’re engrossed in a textbook. Even if you’ve planned to purchase lunch, it’s wise to carry items like muesli bars or fruit for an energy boost should the need arise. It’s a well-known fact that breaks are never a certainty in this profession!

- Fob watch - Certain practices completely prohibit the use of phones and even the wearing of wristwatches by staff. Unless there are plenty of clocks around, you might want to think about using a fob watch (equipped with a second hand) to ensure you’re never at a disadvantage when taking a patient’s heart rate.

- Spare scrub top